How do the announced superannuation changes affect me?… we have crunched the numbers.

The Treasurer announced a proposed change to how superannuation is taxed for large balance holders which affects approximately 80,000 people or 0.5% of superannuation account holders. This change is proposed to be effective from 2025. Here is the link to the recent media release from the Treasurer on Superannuation Tax Breaks.

Do you have more than $3 million in your superannuation account?

If the answer is “no” the changes do not affect you. Superannuation remains a tax effective way to save for your retirement. Earnings on your savings in a superannuation account are taxed at a maximum 15% which is the lowest available tax rate compared to any other investment entity or structure. Furthermore, withdrawals made from your superannuation account after you reach age 60 are tax free. Our general advice is that clients not be deterred from investing in superannuation because of this announcement as superannuation remains a very tax effective retirement saving strategy.

If the answer is “yes”, the changes will affect you. The announcement proposes a tax rate of 30% on superannuation balances above $3 milllion. This announcement will apply to all superannuation accounts, not just those held in SMSF.

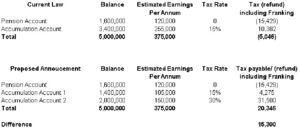

Based on the announcement our interpretation of how these changes are proposed to be implemented is best illustrated by an example. If a client has $5 million in their superannuation account which is invested in a diversified portfolio earning 7.5% per annum with 30% of the income being franked. The client has previously allocated $1.6 million to a “pension” account. Based on our calculations, the additional tax burden on this superannuation account will be approximately $15,300 per annum.

Given this is an announcement only and not yet law our general advice is that clients refrain from making decisions at this time based on this announcement alone. At this time, the announcement does not appear to require assets to be removed from the superannuation environment. However, our general advice for clients with illiquid assets, such as large buildings, is that they continue to ensure their superannuation funds have sufficient liquidity to deal with any changes that may occur in the future.

The Macro Group Pty Ltd holds both a tax agent license and limited AFSL license so well placed to advise on your superannuation tax issues. Please contact us and ask for either Nicole Bryant or Jocelyn Piper to further discuss how these changes may affect you.

Date: 01/03/2023

The Macro Group Limited AFSL:485843 Tax Agent Number 24 76 5236.

The information in this article contains general information only. We have not taken into consideration any of your personal objectives, financial situation or needs. Before taking any action, you should consider whether the general advice contained in this communication is appropriate to you having regard to your circumstances and needs, and seek appropriate professional advice if you think you need it. We recommend that you consult a licensed or authorised financial adviser if you require financial advice that takes into account your personal circumstances.